Who Holds the Most Real Estate in Canada? A Deeper Look at 2026 and What It Means for Families

Why Older Canadians Hold the Most Housing Wealth

Most Canadians assume older adults own a lot of property, but the real story is much larger than many expect. As we move into 2026, national data shows that Canadians in their fifties, sixties and seventies hold more real estate wealth than any other age group. They bought homes when prices were far lower, stayed long enough to pay off mortgages and benefited from decades of rising values that turned ordinary homes into major financial assets.

Statistics Canada’s homeownership tables confirm this. Ownership rates climb steadily with age and peak among adults fifty five and older, who are also the most likely to own their home outright. A house purchased in Toronto or Vancouver in the 1990s for under three hundred thousand dollars may now exceed one million. Smaller cities have seen similar long term gains. You can read the full dataset here:

Statistics Canada Table 11-10-0238-01

How Real Estate Wealth Shapes Aging Decisions

This wealth plays a central role in how Canadians age and plan. Because the home is often the largest asset, it becomes part of almost every decision. Many older adults want to stay home and use their equity for home care, safety modifications or mobility changes. Others look for something smaller that feels easier to manage. Many families compare the cost of home care to the cost of retirement living, and home equity often becomes the tool that makes either option possible.

The idea of a “Great Wealth Transfer” is another major factor. RBC reports that more than a trillion dollars in housing and financial assets will pass from older Canadians to younger generations in the next twenty years. This shift will shape financial planning, caregiving and future housing decisions across the country. Their analysis is available here:

RBC: The Great Wealth Transfer

What Families Consider When a Move Becomes Likely

Behind each statistic is a family working through real choices. A daughter in Mississauga may be helping her mother decide if staying home is safe. A son in Surrey may be comparing home care with retirement residence costs. A couple in their late sixties may want a home closer to family or something with fewer stairs. In every case, the value in the home helps shape the path forward.

Because these decisions involve many moving parts, families often work with several services at once. A seniors focused Realtor helps with planning, timing and market value. Financial planners help map out income needs. Lawyers help with wills, estates and powers of attorney. Retirement living advisors explain care levels and services. Home care providers support independence for those who want to remain at home. Contractors improve safety through accessibility renovations. Downsizing teams help with decades of belongings. Lending specialists explain bridge loans, equity release and reverse mortgage options.

Why Seniors Focused REALTORS Matter

All of these services form a support circle around the homeowner. Because the home usually represents the largest asset, nearly every part of that circle connects back to its value. This makes the role of a seniors focused Realtor especially important. Traditional real estate is about buying and selling. Seniors real estate is about guiding someone into a new stage of life, balancing emotional decisions with practical planning.

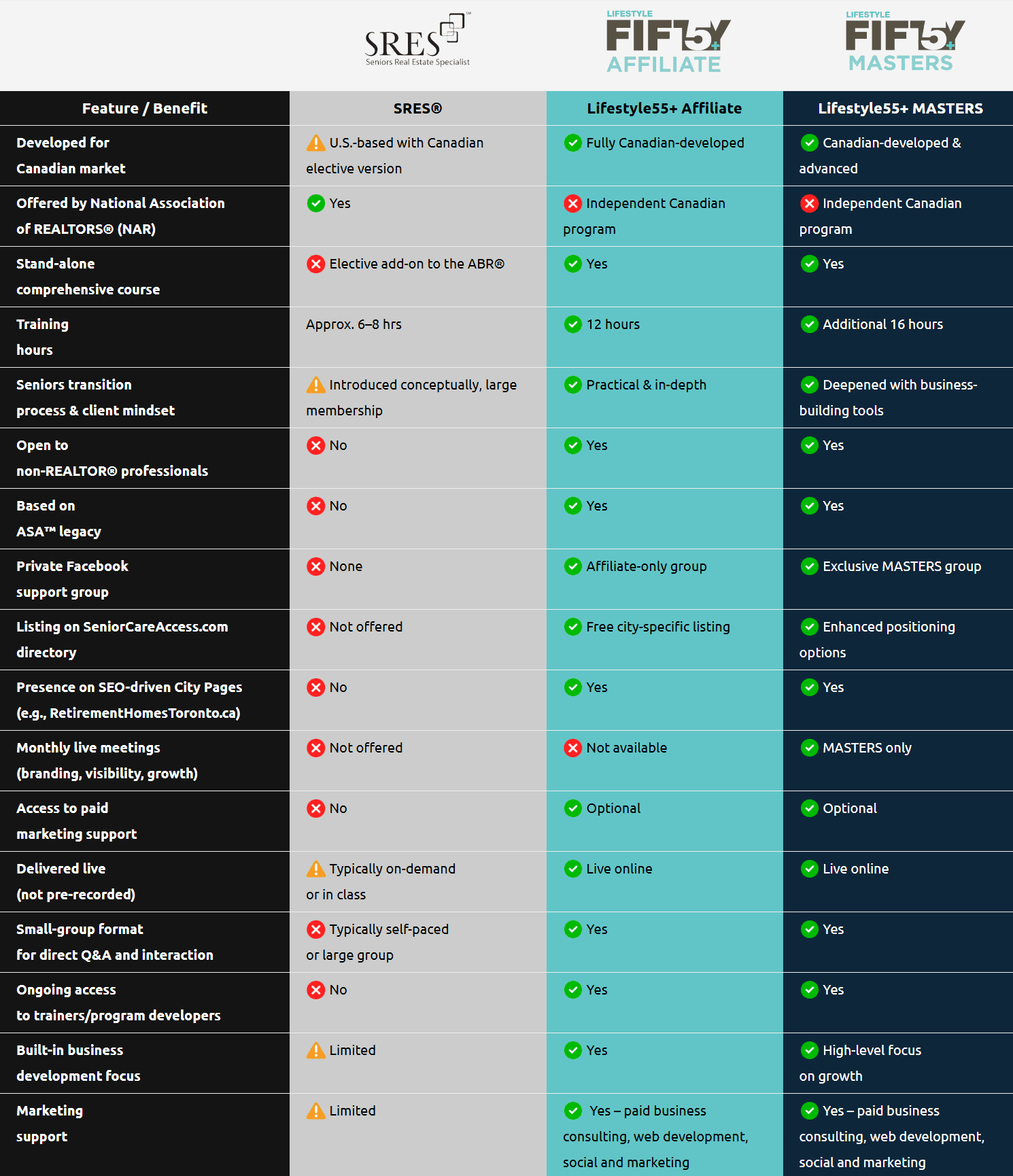

The Lifestyle55 plus Affiliate and Lifestyle55 plus MASTERS programs were created to help professionals understand the needs of older adults and the realities families face during late life transitions. To find trained seniors focused Realtors, the national directory is here:

Lifestyle55+ National Directory

Where Families Turn for Information

Families also rely on trusted information when exploring senior housing and services. SeniorCareAccess.com has grown into a national resource for retirement residences, home care, downsizing help and senior focused supports across Canada. It offers a clear starting point for anyone comparing senior living options:

SeniorCareAccess.com

The Answer and What It Means for Canada

As Canada moves through the next decade, the influence of older homeowners will continue to grow. Their decisions will affect housing supply, retirement living demand, estate planning and multigenerational support. Understanding who holds the most real estate in the country is more than a financial question. It helps explain how Canadians age, how families prepare and how professionals across many sectors help support them.

The answer is clear. Canadians aged fifty five and older hold the largest share of the nation’s real estate wealth. The impact of that reality extends far beyond the housing market and will shape families and communities for many years to come.

Offered by Lifestyle55+ Network Inc. Delivering programs for both Canadian families and professional services managing seniors needs.

www.Lifestyle55Training.com or www.SeniorsRealEstate.ca